Rising salaries and falling performance exert pressure on UK contact centres

Organisations around the UK – and across all vertical market sectors – have had to deal with escalating pressures from various sources in recent times, and the evidence points to the situation with call centres being little different.

In particular, the latest call centre data analysis points to a lethal combination of climbing salaries and difficulties in even returning to pre-pandemic levels of performance.

Pay packets are spiralling

New agent salaries have been firmly on the up at UK contact centres in recent times, reportedly by 9.7% since 2021, bringing the mean average salary of such agents to £21,876 at the end of 2022.

Experienced agents, however, saw an even bigger rise in their pay packets, of 11.3% meaning they took home a mean average salary of £25,164. At team leader level, average salaries were reported to have gone up by 9.6%, while contact centre managers’ salaries rose by 7.4% compared to the situation in 2021, hitting £46,778 on average.

These increases in wages are all hovering around double the rises in 2021, which suggests that they are likely to have been largely driven by inflationary pressures, although at a new agent level, the effect of the increasing National Minimum Wage / National Living Wage should also be considered.

But it is becoming difficult for call centres to keep on delivering performance

2022’s performance metrics for UK call centres were also insightful, albeit worrying for many organisations attempting to achieve the optimal customer experience.

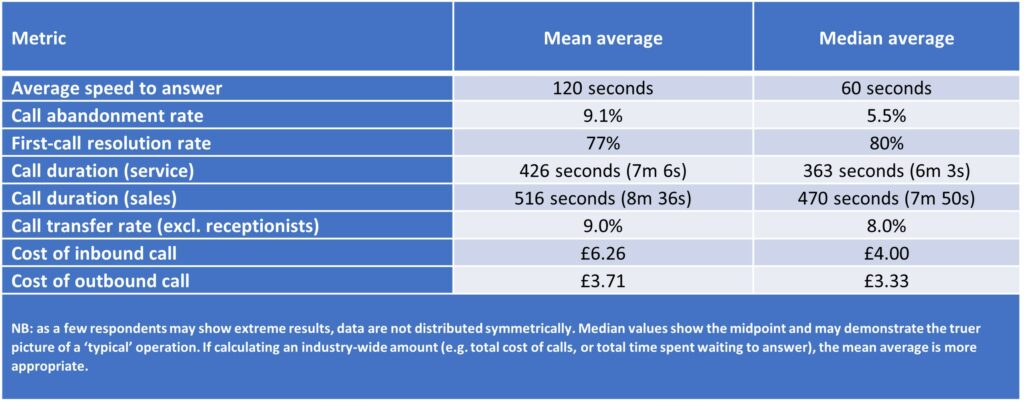

Average speed to answer, for instance, has gone up from a mean of 106 seconds in 2021, to 120 seconds in 2022 – far higher than the pre-pandemic figures of around 30 seconds. This has been fuelled by the difficulties that some call centres are still having in relation to the pandemic and its after-effects, particularly in staffing. The median speed to answer has increased, too, which indicates this rise is a widespread one, not being driven by a relatively small proportion of operations.

Other signs of reasons for concern in the most recent call centre data analysis include call abandonment rates having increased again, from 8.2% to 9.1%, as well as the mean and median costs of an inbound call being considerably above the historical average.

Contact centre performance metrics

All in all, the metrics offer plenty to think about for UK organisations that are keen to get the best out of their contact centres in an environment that continues to be difficult.

There is much more to be learned about the current state of the UK contact centre industry, for those who download our “2023 UK Contact Centre Decision-Makers’ Guide”. This free-to-access document contains far-reaching call centre data analysis that will assist your organisation in making the most informed decisions in 2023 and beyond.

For companies requiring more in-depth detail of HR, salaries, attrition and performance metrics by size band and vertical market, “The 2023 UK Contact Centre HR & Operational Benchmarking Report” is available.